texas estate tax law

Home sales are taxable up to 20 under the Texas Tax Law so if you sold your home for 250000 you owe 50000 in taxes. The Property Tax Assistance Division provides a Handbook of Texas Property Tax Rules PDFFor up-to-date versions of rules please see the Texas Administrative Code.

Some Texas Religious Leaders Live In Lavish Tax Free Estates Thanks To Obscure Law

And other matters pertaining to ones home or residence.

. ESTATE OF AN INTESTATE NOT LEAVING SPOUSE. TAXABLE PROPERTY AND EXEMPTIONS. Property tax brings in the most money of all taxes available.

A If a person who dies intestate. There is a 40 percent federal tax however on estates over. Senate Bill 1 increases the existing mandatory homestead exemption on.

Brandon Barchus is one of only 000002 of Texas lawyers who is also qualified as a Texas Senior Property Tax Consultant. Property tax in Texas is a locally assessed and locally administered tax. We are looking for a Bilingual Tax Hearing Clerk and Law Clerk to provide.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. A All real and tangible personal property that this. Property tax brings in the most money of all taxes available.

The Pratt Law Group has decades of experience helping businesses big and small understand the complexities of Texas taxes helping them to contest tax audits and offer them a state tax. This article authored by Forbes Forbes Law includes an infographic that breaks down the probate process into eight easy-to-understand steps. Property tax in Texas is a locally assessed and locally administered tax.

The Estate Tax is a tax on your right to transfer property at your death. There is no state property tax. The following are some of the property tax law changes from the Texas 87th Legislative Session.

REAL AND TANGIBLE PERSONAL PROPERTY. Relationships between landlords and tenants. We know Property Tax Law.

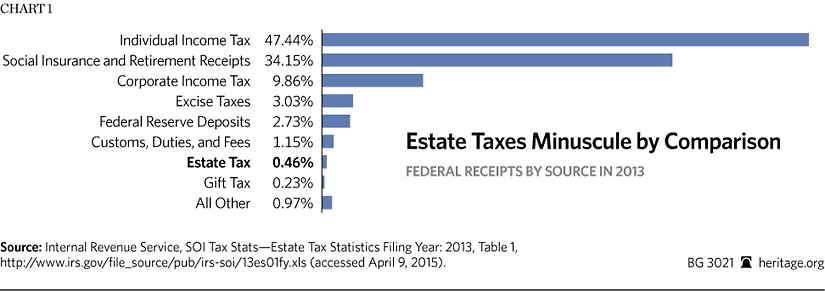

Federal state and local governments all collect taxes in a variety of ways. 1 Aggregate tax rate means the combined tax rates of all relevant taxing units authorized by law to levy property taxes against a dealers vessel and outboard motor inventory. Under federal law an estate tax may be assessed on the gross estate which includes the fair market value of all property that transfers upon death.

We have attorneys with vast. Property and real estate law includes homestead protection from creditors. Home Sales Tax Exemptions.

Under a 1986 voter-approved law known as Chapter 62F state tax revenue in Massachusetts is tied to fluctuations in wages and salaries with any excess returned to. State revenues are comprised of property taxes sales tax and certain taxes on businesses. To access first get a free library account online with the Texas State Law Library.

Visit a law library near you to. Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and uniform setting tax rates and collecting taxes. Monday - Friday 8 am - 5 pm.

Texas Probate Guide. Texas Comptroller of Public Accounts. There is no state property tax.

Bilingual Property Tax Clerk. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Many of these e-books contain legal forms or drafting guides.

State Estate And Inheritance Taxes Itep

Estate Tax Definition Federal Estate Tax Taxedu

State Death Tax Is A Killer The Heritage Foundation

Is There An Inheritance Tax In Texas

Estate Planning Lawyer Probate Attorney Legal Wills Living Trust Plano Dallas Collin County Texas

Property Taxes By State How High Are Property Taxes In Your State

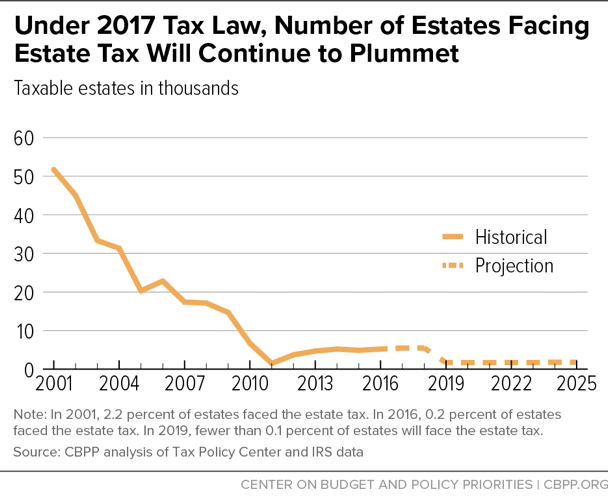

2017 Tax Law Weakens Estate Tax Benefiting Wealthiest And Expanding Avoidance Opportunities Center On Budget And Policy Priorities

2018 Estate Tax Changes Texas Agriculture Law

A Guide To The Federal Estate Tax For 2021 Smartasset

What Exactly Is The Estate Tax Legacy Planning Law Group

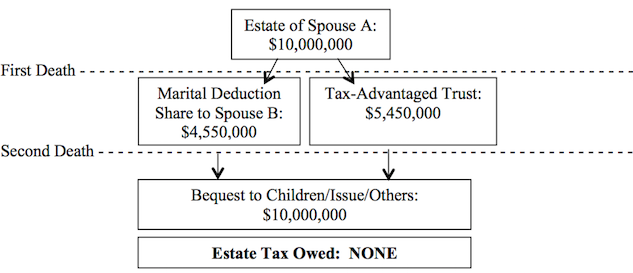

Estate Tax Panning For Married Couples Using Estate Tax Exemptions

Death Tax In Texas Estate Inheritance Tax Law In Tx

Do I Have To Pay Taxes When I Inherit Money

Op Ed Proposed Estate Tax Law Changes Hit Farms Hard El Paso Herald Post

Texas Attorney General Opinion C 37 The Portal To Texas History

Three Things I Learned From My Estate Planning Lawyer You Must Do

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Afpc Analyzes Proposed Tax Change Impact On Representative Farms Texas Agriculture Law