capital gains tax increase canada

Will capital gains taxes increase. Published January 12 2021 Updated February 9 2021.

Comparing Income Corporate Capital Gains Tax Rates 1916 2011 The Big Picture

As of 2022 it stands at 50.

. And if the capital gains. If these rules apply to you you may be able to postpone paying tax on any capital gains you had from the transfer. Capital gains tax rates on most assets held for a year or less correspond to.

From 1867 to 1971 there was no capital gains tax in Canada. In Canada 50 of the value of any capital gains are taxable. This is equivalent to 50 of your capital gain multiplied by your full marginal tax rate.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Capital Gains Tax in Canada 2022.

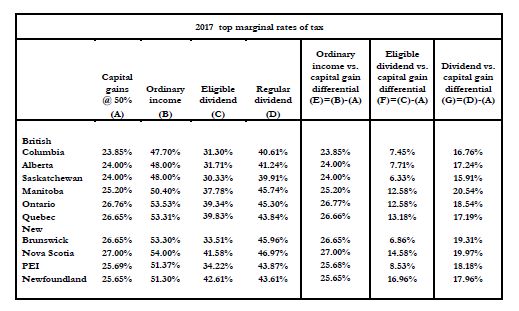

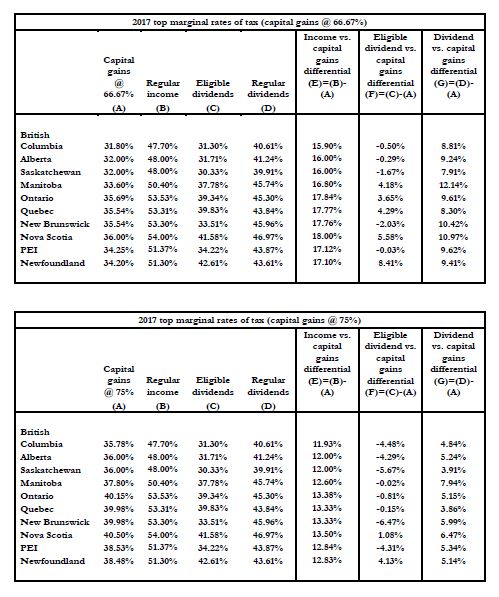

At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for. Since the inclusion rate for capital gains is 50 your taxable income would increase by 5000 in the 2021 tax year. Special to The Globe and Mail.

Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972. Is there a one-time capital gains exemption in Canada. The capital gains exemption is cumulative and.

- LinkedIn 5 days ago Apr 04 2022 And the person with a marginal tax rate of 5353 will face a capital gains tax rate of 3569. Adjusting for inflation 40000 in taxable income in 1994 is equivalent to 63685 in 2020. A 1 percent wealth tax levied on fortunes over 10 million an increase in the capital gains inclusion rate from 50.

When the tax was first. 4 The effective marginal tax rate of 195 per cent incorporates the inclusion rate of. After income taxes and the inflation tax Investor A ends up with a 77-per-cent return the same return as Investor B who was taxed on 100 per cent of her capital gains.

Capital Gains 2021. So for example if you buy a stock at 100 and it earns 50 in value. 1 week ago Jul 07 2022 The taxes in Canada are calculated based on two critical variables.

In 1972 due to the Carter Commission Reports famous conclusion that a buck is a buck is a buck Canada. If your capital gains are 100000 you will be subject to a capital gains tax on 50000. How to prepare for a potential tax hike on capital gains.

1 day agoThe four popular fiscal measures examined in the study are. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. The effective capital gains tax rate in Canada is 50 of your marginal tax rate.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Should you sell the investments at a higher price than you paid realized capital gain youll need to add. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

Capital Gains Tax Rate. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an. If you inherit a property you generally dont have to pay capital gains tax on the increase in value from the time of the original owners purchase to the time of your inheritance.

Different types of realized capital gains are taxed by. Tax on capital gain 5353 b 10706 16059 0 0 Tax savings from 5041 donation tax credit c 25205 25205 25205 25205 Total cost of donation a b c 35501. How are capital gains calculated.

The inclusion rate is the percentage of your gains that are subject to tax. The inclusion rate refers. The inclusion rate has varied over time see graph below.

The capital gains tax is the same for everyone in Canada currently 50.

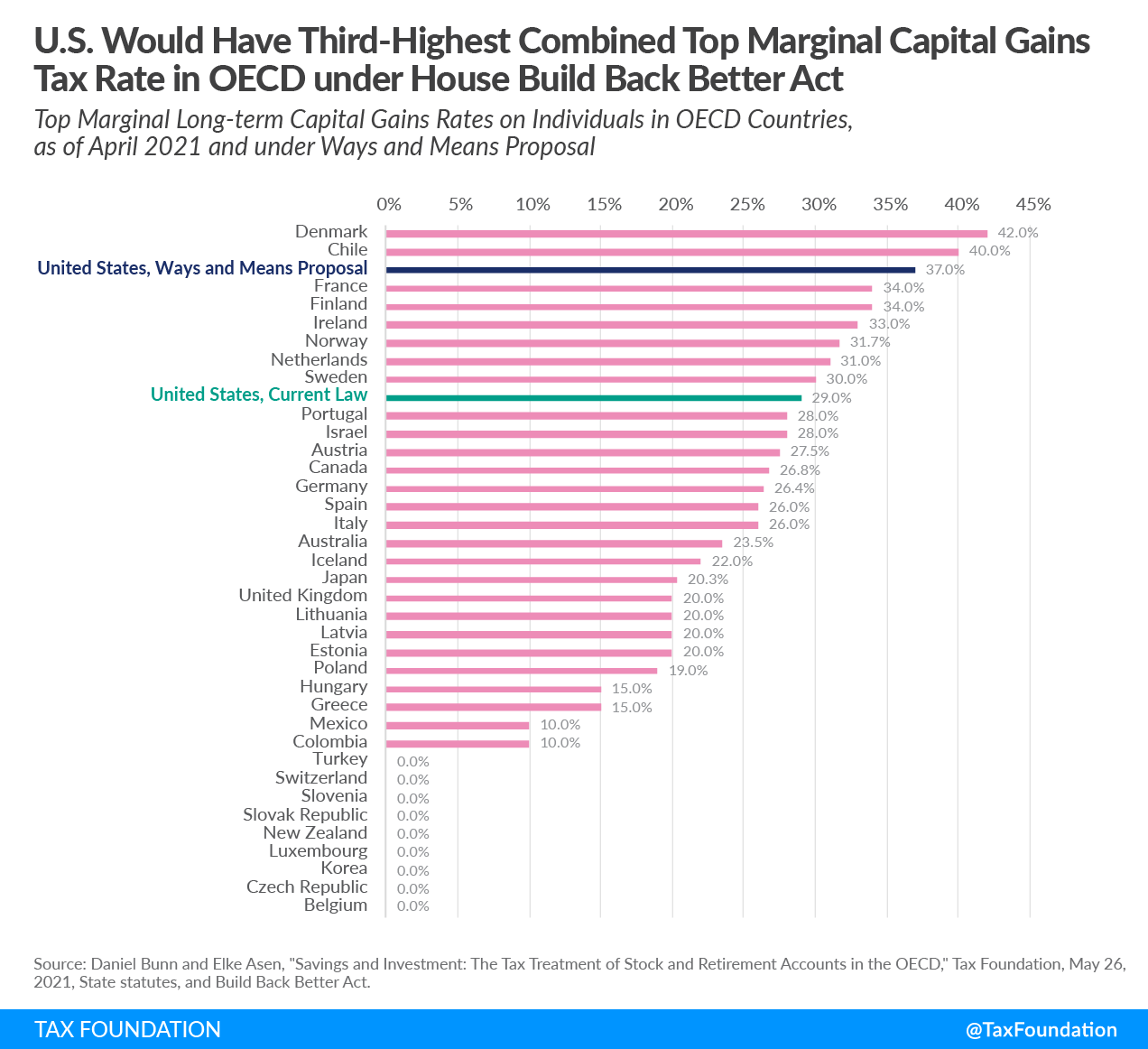

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

How Are Capital Gains Taxed Tax Policy Center

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Capital Gains Tax In Canada And The U S Tax 101 Youtube

Capital Gains Tax Reform In Canada Lessons From Abroad Fraser Institute

Kalfa Law Capital Gains Exemption 2020 Capital Gains Tax

Planning Around The 2017 Federal Budget Possible Changes To The Capital Gains Inclusion Rate Tax Authorities Canada

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

The Us Would Have The Third Highest Combined Top Marginal Capital Gains Tax Rate Among Oced Countries Topforeignstocks Com

Planning Around The 2017 Federal Budget Possible Changes To The Capital Gains Inclusion Rate Tax Authorities Canada

Investing Series How Does The Capital Gains Tax Work In Canada Save Spend Splurge

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

2016 Federal Budget Commentary Pacific Spirit Vancouver Financial Advisors Wealth Management

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)